Risk Management And Insurance Course

Risk Management And Insurance Course - Build a strong foundation in risk management and insurance whether you want to succeed in claims, underwriting, sales, or marketing. Insurance risk management prepares you for jobs all over the world. This course covers principles of risk management and insurance planning, with a focus on measurements of uncertainty, associated financial costs, and corporate risk management planning. Our certificate in risk management and insurance provides students with a basic understanding of the many aspects of risk management and insurance (rmi), concentrating on value creation and asset protection—knowledge vital for careers in financial and credit analysis, corporate risk management, risk management consulting, employee benefits manag. Rider’s risk management and insurance certificate program provides students with the skills, tools and practical training experience needed to succeed in the rapidly evolving risk management landscape. Risk management and insurance education and information from irmi (international risk management institute). Decide options on various risks and insurance plans An associate in applied science (aas) in risk management and insurance is also available. The arm designation requires three core courses: Build a skillful insurance and risk assessment framework; Risk management & insurance certificate (online) prepare for a career with the fundamentals of the insurance industry, principles of property and liability insurance, health, life, personal, and commercial insurance, and risk management. Courses offer a framework of knowledge including an introduction to the insurance industry, risk management, principles of property and liability insurance, health, life, personal, and commercial insurance. Those who have a minimum of three years of risk management, insurance, or other financial services work experience and a high school diploma, or ged may also apply. Build a strong foundation in risk management and insurance whether you want to succeed in claims, underwriting, sales, or marketing. Try the associate in risk management program for free with this sample course. Build a skillful insurance and risk assessment framework; Differentiate yourself from other school’s graduates. The arm designation requires three core courses: Insurance risk management prepares you for jobs all over the world. Develop a comprehensive risk management strategy using insurance products in three key categories: Explore gallaudet university's rmi 201 course on risk management and insurance. The certificate in risk management and insurance prepares students for the associate in risk management (arm) designation offered by the institutes®, the leading professional organization on risk management and insurance. In business administration degree with a major in risk management and insurance. Courses offer a framework of knowledge including. Explore gallaudet university's rmi 201 course on risk management and insurance. This masterclass combines the content of our four most popular and practical courses—fundamentals of risk management (form), embedding risk management (erm), practical risk appetite & tolerance (prat), and effective risk workshops—into a tailored program covering the essentials of risk management. Every course has benefited my career in some fashion.. Click for the description of all 5 courses. Handle the sources of risk in the business; Actuaries made a median annual wage of $120,000 as of may 2023, as reported. The certificate in risk management and insurance prepares students for the associate in risk management (arm) designation offered by the institutes®, the leading professional organization on risk management and insurance.. Risk management & insurance certificate (online) prepare for a career with the fundamentals of the insurance industry, principles of property and liability insurance, health, life, personal, and commercial insurance, and risk management. Risk management plays a crucial security role at organizations around the globe. Click for the description of all 5 courses. An associate in applied science (aas) in risk. Develop a comprehensive risk management strategy using insurance products in three key categories: Actuaries made a median annual wage of $120,000 as of may 2023, as reported. This masterclass combines the content of our four most popular and practical courses—fundamentals of risk management (form), embedding risk management (erm), practical risk appetite & tolerance (prat), and effective risk workshops—into a tailored. Build a strong foundation in risk management and insurance whether you want to succeed in claims, underwriting, sales, or marketing. An associate in applied science (aas) in risk management and insurance is also available. Explore gallaudet university's rmi 201 course on risk management and insurance. The arm designation requires three core courses: This masterclass combines the content of our four. The arm designation requires three core courses: This insurance and risk management training course will provide trainees with the skills and techniques in insurance and risk management issues and in particular: This masterclass combines the content of our four most popular and practical courses—fundamentals of risk management (form), embedding risk management (erm), practical risk appetite & tolerance (prat), and effective. The certificate in risk management and insurance prepares students for the associate in risk management (arm) designation offered by the institutes®, the leading professional organization on risk management and insurance. Our certificate in risk management and insurance provides students with a basic understanding of the many aspects of risk management and insurance (rmi), concentrating on value creation and asset protection—knowledge. Every course has benefited my career in some fashion. Books, webinars, courses, free articles. Risk management & insurance certificate (online) prepare for a career with the fundamentals of the insurance industry, principles of property and liability insurance, health, life, personal, and commercial insurance, and risk management. Develop a comprehensive risk management strategy using insurance products in three key categories: The. The arm designation requires three core courses: The risk management and insurance certificate gets you industry ready and gives you a solid background in risk management, claims, current market trends, and personal and commercial lines insurance, including property and automobile. Unlock your potential as a future business leader with a program that’s been ranked #1 risk management & insurance program. Rider’s risk management and insurance certificate program provides students with the skills, tools and practical training experience needed to succeed in the rapidly evolving risk management landscape. You will learn the fundamentals of risk management as applied in the insurance and reinsurance industries. Every course has benefited my career in some fashion. Risk management & insurance certificate (online) prepare for a career with the fundamentals of the insurance industry, principles of property and liability insurance, health, life, personal, and commercial insurance, and risk management. The arm designation requires three core courses: An associate in applied science (aas) in risk management and insurance is also available. Decide options on various risks and insurance plans This course covers principles of risk management and insurance planning, with a focus on measurements of uncertainty, associated financial costs, and corporate risk management planning. Develop a comprehensive risk management strategy using insurance products in three key categories: R m i 705 — risk management and technologies in a digital age. Risk management and insurance education and information from irmi (international risk management institute). Courses offer a framework of knowledge including an introduction to the insurance industry, risk management, principles of property and liability insurance, health, life, personal, and commercial insurance. Those who have a minimum of three years of risk management, insurance, or other financial services work experience and a high school diploma, or ged may also apply. Risk in an evolving world; Risk management plays a crucial security role at organizations around the globe. In business administration degree with a major in risk management and insurance.MBA Insurance and Risk Management Course, Admission, College

Insurance and Risk Management OrientMCT

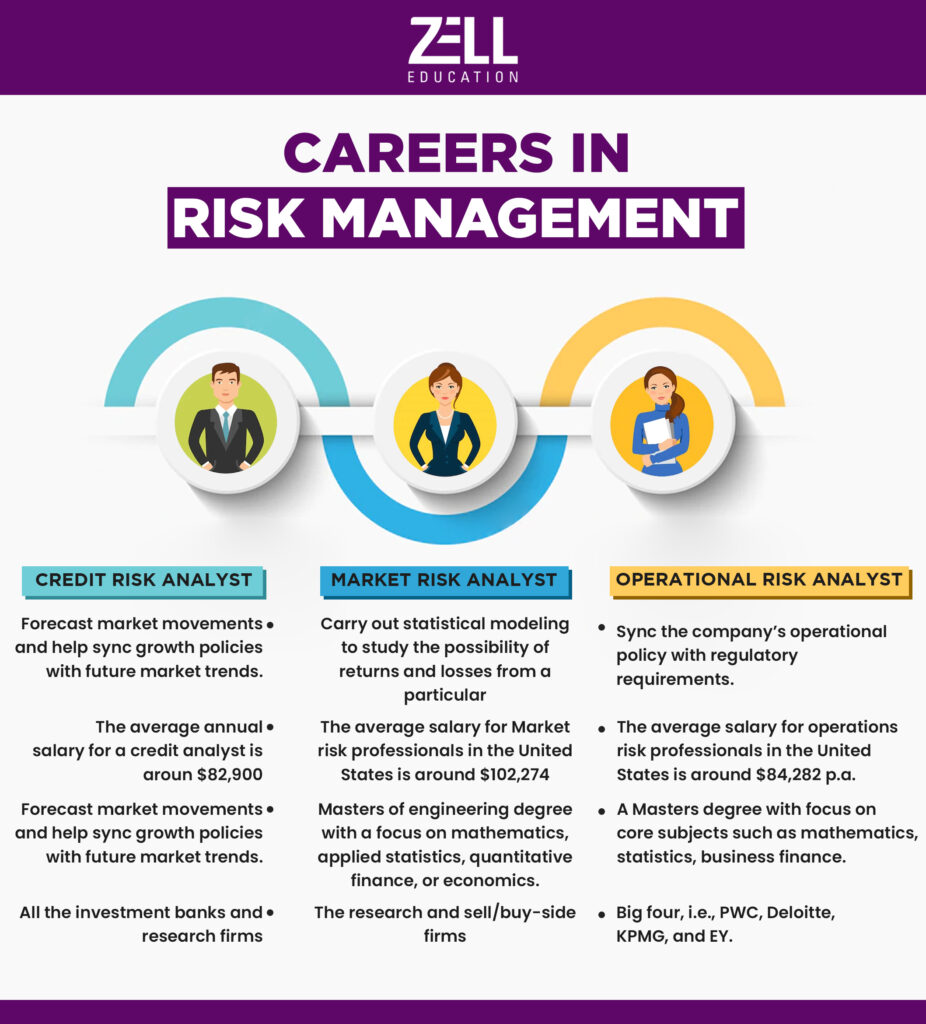

6 MBA Finance Alternative Courses & Career Options ZELL Education

Risk Management and Insurance Training Training SDM

Principles of Risk Management and Insurance by Rejda 13th Global

Insurance And Risk Management

What Is The Importance Of Risk Management In Insurance?

Introduction to Risk Management & Insurance

Introduction to Risk Management and Insurance, 10th edition eTextBook

Principles of Risk Management and Insurance 13th Edtn By Rejda

This Course Promotes An Understanding Of Individual And Enterprise Risk Management And How The Financial Consequences Of Risk Exposure Can Be Managed Using Insurance, Risk Control And Other Financing Techniques.

Build A Strong Foundation In Risk Management And Insurance Whether You Want To Succeed In Claims, Underwriting, Sales, Or Marketing.

Develop Insight Into The Principles Of Risk Management, Including Institutions Engaged In Identifying, Assessing, Preventing, Mitigating, And Transferring Risk.

Gain Essential Skills For Navigating The Complexities Of Risk In Various Sectors.

Related Post: