Lbo Course

Lbo Course - Define leveraged buyouts and their significance in corporate finance. During the course, you will learn how to build. This course provides a basic overview and introduction to leveraged buyouts, including discussion of rationale for ‘going private’, ideal lbo candidate, drivers of value. As leveraged finance practitioner in bb bank can only fully recommend wso lbo modelling course to all who needs practical experience of using leveraged finance and understanding. Our leveraged buyout course covers the definition of lbo, internal rate of return (irr) and value. Understand the mechanics, drivers, and key formulas in leveraged. Welcome to the cba education portal. Build a simple lbo model and forecast income statements. 💻download free lbo model templates: Have an upcoming interview with an lbo test? 💻download free lbo model templates: The courses listed below provide a taste of the commercial, business, and labor law courses offered at the law school, although no formal groupings exist in our curriculum. This course provides a basic overview and introduction to leveraged buyouts, including discussion of rationale for ‘going private’, ideal lbo candidate, drivers of value. Have an upcoming interview with an lbo test? Define leveraged buyouts and their significance in corporate finance. Understand what is a leverage buyout, how to model an lbo transaction in private equity. Learn leveraged buyouts (lbos) with cfi's newest course. As leveraged finance practitioner in bb bank can only fully recommend wso lbo modelling course to all who needs practical experience of using leveraged finance and understanding. Understand the mechanics, drivers, and key formulas in leveraged. Build a simple lbo model and forecast income statements. Up to 10% cash back understand the foundational structures and strategies of private equity funds. Build a simple lbo model and forecast income statements. The courses listed below provide a taste of the commercial, business, and labor law courses offered at the law school, although no formal groupings exist in our curriculum. Learn more in cfi’s lbo modeling course! Plain. 💻download free lbo model templates: Explore sources & uses schedules and calculate equity returns. Through the 6 “conceptual” lbo models, interview questions, and 6 full case studies in the course, you’ll learn to: Understand what is a leverage buyout, how to model an lbo transaction in private equity. During the course, you will learn how to build. Build a simple lbo model and forecast income statements. Plain curious about financial modeling? Through the 6 “conceptual” lbo models, interview questions, and 6 full case studies in the course, you’ll learn to: Define leveraged buyouts and their significance in corporate finance. The purpose of this course is to provide you with an overview of lbo strategies and to introduce. In an lbo, the goal of the investing company or buyer is to make high returns on their equity investment, using debt to increase the potential returns. Define leveraged buyouts and their significance in corporate finance. Learn more in cfi’s lbo modeling course! This course provides a basic overview and introduction to leveraged buyouts, including discussion of rationale for ‘going. Our leveraged buyout course covers the definition of lbo, internal rate of return (irr) and value. Build a simple lbo model and forecast income statements. The courses listed below provide a taste of the commercial, business, and labor law courses offered at the law school, although no formal groupings exist in our curriculum. The purpose of this course is to. You will start by learning about basic lbo concepts, typical deal structures, and current industry dynamics. The courses listed below provide a taste of the commercial, business, and labor law courses offered at the law school, although no formal groupings exist in our curriculum. This course provides a basic overview and introduction to leveraged buyouts, including discussion of rationale for. 💻download free lbo model templates: Learn more in cfi’s lbo modeling course! This course provides a basic overview and introduction to leveraged buyouts, including discussion of rationale for ‘going private’, ideal lbo candidate, drivers of value. Build a simple lbo model and forecast income statements. During the course, you will learn how to build. Understand the mechanics, drivers, and key formulas in leveraged. Our leveraged buyout course covers the definition of lbo, internal rate of return (irr) and value. Plain curious about financial modeling? During the course, you will learn how to build. Understand what is a leverage buyout, how to model an lbo transaction in private equity. Have an upcoming interview with an lbo test? The course provides a comprehensive understanding of private equity investment funds and leveraged buyout (lbo) transactions. Build a simple lbo model and forecast income statements. Learn leveraged buyouts (lbos) with cfi's newest course. In an lbo, the goal of the investing company or buyer is to make high returns on their equity. Build a simple lbo model and forecast income statements. Learn more in cfi’s lbo modeling course! Our leveraged buyout course covers the definition of lbo, internal rate of return (irr) and value. In an lbo, the goal of the investing company or buyer is to make high returns on their equity investment, using debt to increase the potential returns. Understand. In an lbo, the goal of the investing company or buyer is to make high returns on their equity investment, using debt to increase the potential returns. Up to 10% cash back understand the foundational structures and strategies of private equity funds. In this course, you will learn how to build a real, complex lbo model from scratch. As leveraged finance practitioner in bb bank can only fully recommend wso lbo modelling course to all who needs practical experience of using leveraged finance and understanding. The purpose of this course is to provide you with an overview of lbo strategies and to introduce you to restructuring and the bankruptcy process. The course provides a comprehensive understanding of private equity investment funds and leveraged buyout (lbo) transactions. Plain curious about financial modeling? Have an upcoming interview with an lbo test? The courses listed below provide a taste of the commercial, business, and labor law courses offered at the law school, although no formal groupings exist in our curriculum. Learn more in cfi’s lbo modeling course! Learn leveraged buyouts (lbos) with cfi's newest course. You will start by learning about basic lbo concepts, typical deal structures, and current industry dynamics. Understand the mechanics, drivers, and key formulas in leveraged. This course provides a basic overview and introduction to leveraged buyouts, including discussion of rationale for ‘going private’, ideal lbo candidate, drivers of value. Our leveraged buyout course covers the definition of lbo, internal rate of return (irr) and value. Build a simple lbo model and forecast income statements.Corporate Finance Institute

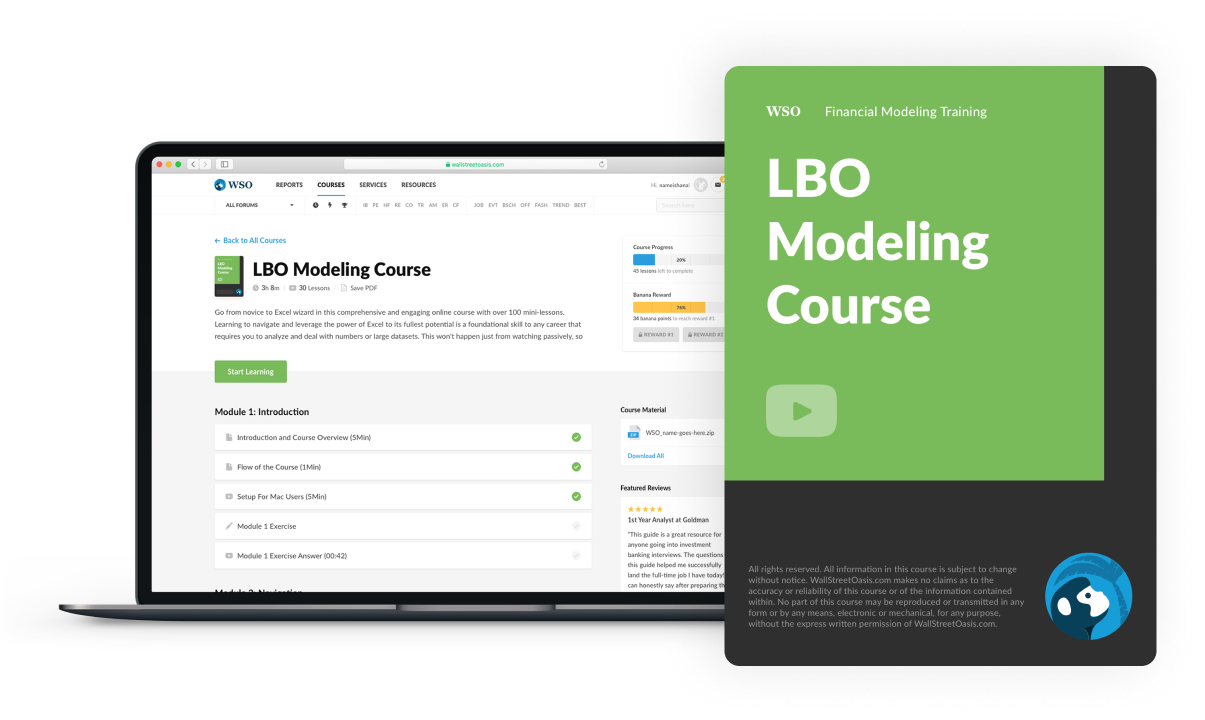

LBO Model Leveraged Buyout LBO Modeling Course

Lbo Course Notes Sample PDF Leveraged Buyout Private Equity

Complete Leveraged Buyout (LBO) Course

Corporate Finance Institute

LBO Model Leveraged Buyout LBO Modeling Course

Leveraged Buyout (LBO) Modeling Course at CFI CFI

LBO Modeling Course Overview Wall Street Oasis

Leveraged Buyout (LBO) Modeling Course at CFI CFI

Leveraged Buyout (LBO) Modeling Course at CFI CFI

Through The 6 “Conceptual” Lbo Models, Interview Questions, And 6 Full Case Studies In The Course, You’ll Learn To:

Understand What Is A Leverage Buyout, How To Model An Lbo Transaction In Private Equity.

Define Leveraged Buyouts And Their Significance In Corporate Finance.

Welcome To The Cba Education Portal.

Related Post: