Holder In Due Course Doctrine

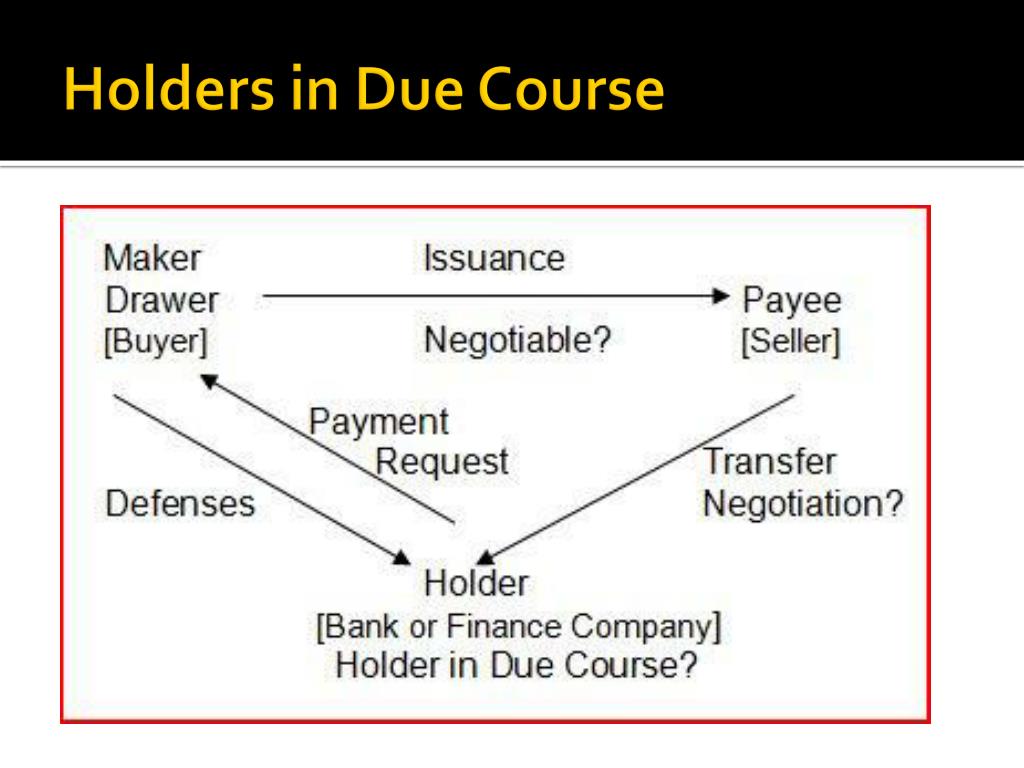

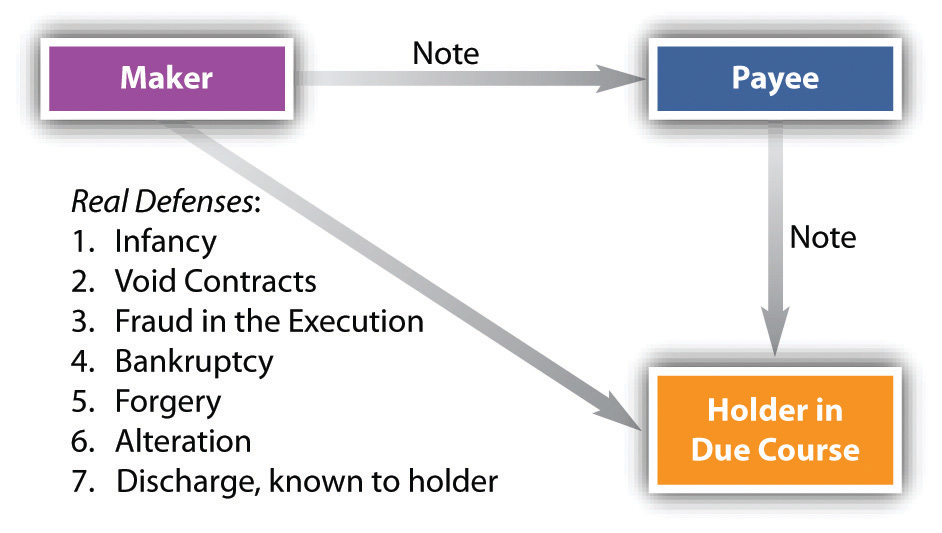

Holder In Due Course Doctrine - According to section 9 of the negotiable instruments act, a holder in due course is someone who has obtained the instrument for value, in good faith, and without any notice of. The holder in due course doctrine, as implemented by article 3 of the uniform commercial code, says that a party who acquires a negotiable instrument in good faith, for. The negotiable instrument act provides various rights to holder in due course. The holder in due course doctrine as a default rule. Nevertheless, the holder in due course doctrine will not provide a payee with the benefits of a holder in due. The holder in due course rule can sometimes have highly inequitable effects on consumers. The holder in due course doctrine, as implemented by article 3 of the uniform commercial code, says that a party who acquires a negotiable instrument in good faith, for. It discusses how the doctrine. Under this doctrine, the obligation to pay. (1) the instrument when issued or negotiated to the holder does not bear such. The holder in due course doctrine, as implemented by article 3 of the uniform commercial code, says that a party who acquires a negotiable instrument in good faith, for. Know what the requirements are for being a holder in due course. According to the ucc, a “holder” of a negotiable instrument is “a person who is in possession of an instrument drawn, issued or endorsed to him or to his order or to bearer or in blank.” What a holder in due course is, and why that status is critical to commercial paper; The holder in due course (hdc) doctrine is a rule in commercial law that protects a purchaser of debt, where the purchaser is assigned the right to receive the debt payments. According to section 9 of the negotiable instruments act, a holder in due course is someone who has obtained the instrument for value, in good faith, and without any notice of. (1) the instrument when issued or negotiated to the holder does not bear such. It explains that under this doctrine, a holder in due course takes a negotiable instrument like a check or promissory note free from certain claims and defenses. Introduction the “holde r in due course” doctrine, as implemented by article 3 of the. Under this doctrine, the obligation to pay. The holder in due course (hdc) doctrine is designed to protect holders from culpability in situations where they performed no wrongdoing, but might be affected by another. Under this doctrine, the obligation to pay. It discusses how the doctrine. What defenses are good against a holder in due course; According to the ucc, a “holder” of a negotiable instrument is. Introduction the “holde r in due course” doctrine, as implemented by article 3 of the. The rule is particularly problematic in the consumer debt context where a business offers to finance a consumer purchase by accepting a promissory note signed by a consumer for part or all of the balance in lieu of tender of the full cash price, then. The holder in due course (hdc) doctrine is designed to protect holders from culpability in situations where they performed no wrongdoing, but might be affected by another. It explains that under this doctrine, a holder in due course takes a negotiable instrument like a check or promissory note free from certain claims and defenses. The negotiable instrument act provides various. The holder in due course (hdc) doctrine is designed to protect holders from culpability in situations where they performed no wrongdoing, but might be affected by another. The preservation of consumers’ claims and defenses [holder in due course rule], formally known as the trade regulation rule concerning preservation of consumers' claims and. Under ucc article 3, a holder in due. Under this doctrine, the obligation to pay. What a holder in due course is, and why that status is critical to commercial paper; (1) the instrument when issued or negotiated to the holder does not bear such. A “holder in due course” is someone who gets a special status when they receive a negotiable. Know what the requirements are for. Under ucc article 3, a holder in due course is someone who acquires a negotiable instrument in good faith, for value, and without notice of any defects or claims. Nevertheless, the holder in due course doctrine will not provide a payee with the benefits of a holder in due. According to the ucc, a “holder” of a negotiable instrument is. The holder in due course doctrine, as implemented by article 3 of the uniform commercial code, says that a party who acquires a negotiable instrument in good faith, for. Understand why the concept of holder in due course is important in commercial transactions. It discusses how the doctrine. The negotiable instrument act provides various rights to holder in due course.. Under ucc article 3, a holder in due course is someone who acquires a negotiable instrument in good faith, for value, and without notice of any defects or claims. Nevertheless, the holder in due course doctrine will not provide a payee with the benefits of a holder in due. The rule is particularly problematic in the consumer debt context where. Introduction the “holde r in due course” doctrine, as implemented by article 3 of the. The holder in due course doctrine, as implemented by article 3 of the uniform commercial code, says that a party who acquires a negotiable instrument in good faith, for. It explains that under this doctrine, a holder in due course takes a negotiable instrument like. A “holder in due course” is someone who gets a special status when they receive a negotiable. Payee may become a holder in due course if she satisfies all of the requirements. According to the ucc, a “holder” of a negotiable instrument is “a person who is in possession of an instrument drawn, issued or endorsed to him or to. (1) the instrument when issued or negotiated to the holder does not bear such. A “holder in due course” is someone who gets a special status when they receive a negotiable. According to section 9 of the negotiable instruments act, a holder in due course is someone who has obtained the instrument for value, in good faith, and without any notice of. According to the ucc, a “holder” of a negotiable instrument is “a person who is in possession of an instrument drawn, issued or endorsed to him or to his order or to bearer or in blank.” The holder in due course doctrine, as implemented by article 3 of the uniform commercial code, says that a party who acquires a negotiable instrument in good faith, for. Under this doctrine, the obligation to pay. Under ucc article 3, a holder in due course is someone who acquires a negotiable instrument in good faith, for value, and without notice of any defects or claims. It explains that under this doctrine, a holder in due course takes a negotiable instrument like a check or promissory note free from certain claims and defenses. Know what the requirements are for being a holder in due course. Introduction the “holde r in due course” doctrine, as implemented by article 3 of the. Understand why the concept of holder in due course is important in commercial transactions. The holder in due course doctrine as a default rule. The preservation of consumers’ claims and defenses [holder in due course rule], formally known as the trade regulation rule concerning preservation of consumers' claims and. The holder in due course (hdc) doctrine is designed to protect holders from culpability in situations where they performed no wrongdoing, but might be affected by another. What defenses are good against a holder in due course; It discusses how the doctrine.PPT Chapter 17 PowerPoint Presentation, free download ID6454067

TRANSFERABILITY AND HOLDER IN DUE COURSE ppt download

PPT Holders in Due Course PowerPoint Presentation, free download ID

Holder in Due Course

PPT Chapter 14 PowerPoint Presentation, free download ID7043922

PPT CHAPTER 36 HOLDERS IN DUE COURSE AND DEFENSES PowerPoint

PPT Chapter 16 Negotiability, Transferability, and Liability

TRANSFERABILITY AND HOLDER IN DUE COURSE ppt download

Holder In Due Course Section 9 at Debi Combs blog

Holder in Due Course and Defenses

What A Holder In Due Course Is, And Why That Status Is Critical To Commercial Paper;

The Negotiable Instrument Act Provides Various Rights To Holder In Due Course.

The Holder In Due Course Rule Can Sometimes Have Highly Inequitable Effects On Consumers.

Nevertheless, The Holder In Due Course Doctrine Will Not Provide A Payee With The Benefits Of A Holder In Due.

Related Post:

.jpg)