Chapter 13 Bankruptcy Financial Management Course

Chapter 13 Bankruptcy Financial Management Course - Learn about the required financial management course (second course) in bankruptcy, designed to help you manage finances and avoid future financial issues. Up to 25% cash back in both chapter 7 and chapter 13 bankruptcy, you (and your spouse if you file jointly) must take two courses before you receive a bankruptcy. Online chapter 13 bankruptcy course finally financial freedom! Once you complete the course you will receive a debtor education certificate. Go to the online course 13class.com. Welcome to ten's online course for debtors who have already filed their chapter 13 petition and have been directed to this site by their trustee. The debtor must complete the educational courses before. Finally financial freedom is the. Sign up onlineattorney recommendedask questionsus trustee approved Everyone seeking chapter 13 bankruptcy relief has to complete a mandatory credit counseling class before their case can be filed with the bankruptcy court. These may not be provided at the same time. Once you complete the course you will receive a debtor education certificate. In chapter 13 bankruptcy, the debtor proposes a repayment plan to pay off creditors over three to five years. Learn about the required financial management course (second course) in bankruptcy, designed to help you manage finances and avoid future financial issues. Welcome to ten's online course for debtors who have already filed their chapter 13 petition and have been directed to this site by their trustee. Sign up onlineattorney recommendedask questionsus trustee approved Information for debtors includes an overview of chapter 13, accessing case information online, making plan payments online, and taking a financial management course online. Online chapter 13 bankruptcy course finally financial freedom! Online chapter 13 bankruptcy course finally financial freedom! The purpose of the debtor education class is to teach you how to budget your income and responsibly manage. Finally financial freedom is the. In chapter 13 bankruptcy, the debtor proposes a repayment plan to pay off creditors over three to five years. Up to 25% cash back in both chapter 7 and chapter 13 bankruptcy, you (and your spouse if you file jointly) must take two courses before you receive a bankruptcy. Individuals filing chapter 13 bankruptcy are. Welcome to ten's online course for debtors who have already filed their chapter 13 petition and have been directed to this site by their trustee. Individuals filing chapter 13 bankruptcy are required to complete a personal financial management course offered by a provider approved by the united states trustee. Information for debtors includes an overview of chapter 13, accessing case. Online chapter 13 bankruptcy course finally financial freedom! Once you complete the course you will receive a debtor education certificate. The debtor must complete the educational courses before. Welcome to ten's online course for debtors who have already filed their chapter 13 petition and have been directed to this site by their trustee. Individuals filing chapter 13 bankruptcy are required. Online chapter 13 bankruptcy course finally financial freedom! Once you complete the course you will receive a debtor education certificate. The debtor must complete the educational courses before. In chapter 13 bankruptcy, the debtor proposes a repayment plan to pay off creditors over three to five years. In accordance with the bankruptcy abuse prevention and consumer protection act of 2005. Everyone seeking chapter 13 bankruptcy relief has to complete a mandatory credit counseling class before their case can be filed with the bankruptcy court. Once you complete the course you will receive a debtor education certificate. Sign up onlineattorney recommendedask questionsus trustee approved Finally financial freedom is the. Up to 25% cash back in both chapter 7 and chapter 13. Finally financial freedom is the. Online chapter 13 bankruptcy course finally financial freedom! In accordance with the bankruptcy abuse prevention and consumer protection act of 2005 (bapcpa), consumers who would like to receive a discharge of a chapter 13 bankruptcy are. Information for debtors includes an overview of chapter 13, accessing case information online, making plan payments online, and taking. Up to 25% cash back in both chapter 7 and chapter 13 bankruptcy, you (and your spouse if you file jointly) must take two courses before you receive a bankruptcy. Learn about the required financial management course (second course) in bankruptcy, designed to help you manage finances and avoid future financial issues. No way to failrush filing available Once you. Ten is the group of bankruptcy trustees and financial educators who developed the course. Online chapter 13 bankruptcy course finally financial freedom! Welcome to ten's online course for debtors who have already filed their chapter 13 petition and have been directed to this site by their trustee. In accordance with the bankruptcy abuse prevention and consumer protection act of 2005. Up to 25% cash back in both chapter 7 and chapter 13 bankruptcy, you (and your spouse if you file jointly) must take two courses before you receive a bankruptcy. Welcome to ten's online course for debtors who have already filed their chapter 13 petition and have been directed to this site by their trustee. In accordance with the bankruptcy. Welcome to ten's online course for debtors who have already filed their chapter 13 petition and have been directed to this site by their trustee. Once you complete the course you will receive a debtor education certificate. Information for debtors includes an overview of chapter 13, accessing case information online, making plan payments online, and taking a financial management course. Everyone seeking chapter 13 bankruptcy relief has to complete a mandatory credit counseling class before their case can be filed with the bankruptcy court. Welcome to ten's online course for debtors who have already filed their chapter 13 petition and have been directed to this site by their trustee. Individuals filing chapter 13 bankruptcy are required to complete a personal financial management course offered by a provider approved by the united states trustee. Welcome to ten's online course for debtors who have already filed their chapter 13 petition and have been directed to this site by their trustee. Up to 25% cash back in both chapter 7 and chapter 13 bankruptcy, you (and your spouse if you file jointly) must take two courses before you receive a bankruptcy. Learn about the required financial management course (second course) in bankruptcy, designed to help you manage finances and avoid future financial issues. Online chapter 13 bankruptcy course finally financial freedom! Sign up onlineattorney recommendedask questionsus trustee approved These may not be provided at the same time. In accordance with the bankruptcy abuse prevention and consumer protection act of 2005 (bapcpa), consumers who would like to receive a discharge of a chapter 13 bankruptcy are. The purpose of the debtor education class is to teach you how to budget your income and responsibly manage. Go to the online course 13class.com. Information for debtors includes an overview of chapter 13, accessing case information online, making plan payments online, and taking a financial management course online. Ten is the group of bankruptcy trustees and financial educators who developed the course. Once you complete the course you will receive a debtor education certificate. Online chapter 13 bankruptcy course finally financial freedom!What Is Chapter 13 Bankruptcy? Finance Training Topics

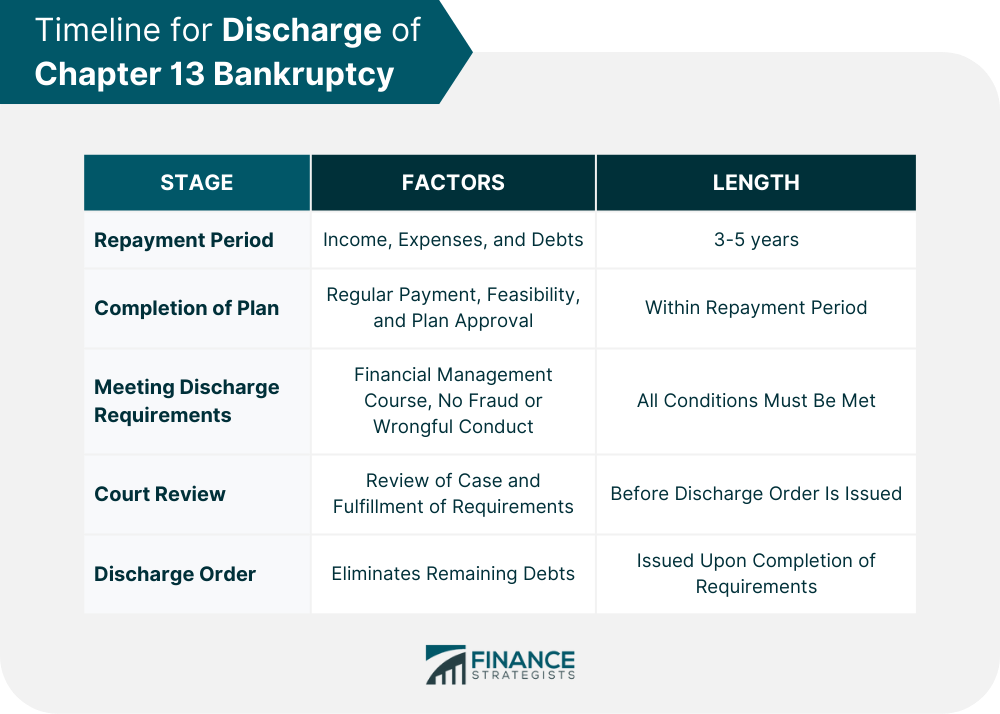

When Does Chapter 13 Bankruptcy Get Discharged?

FHA Guidelines After Chapter 13 Bankruptcy

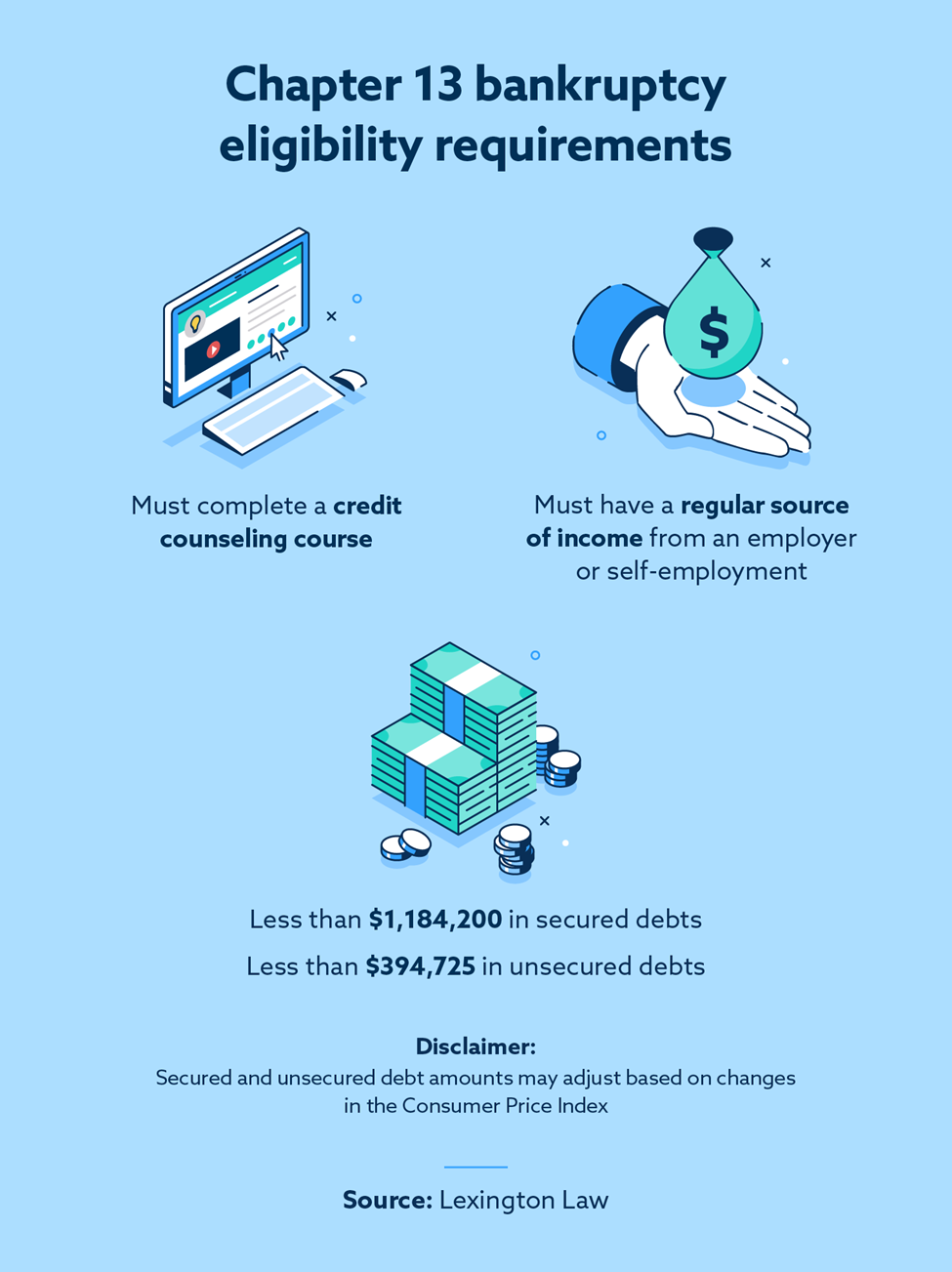

Chapter 13 Eligibility in New Jersey Millburn Bankruptcy Attorneys

Chapter 13 Bankruptcy AwesomeFinTech Blog

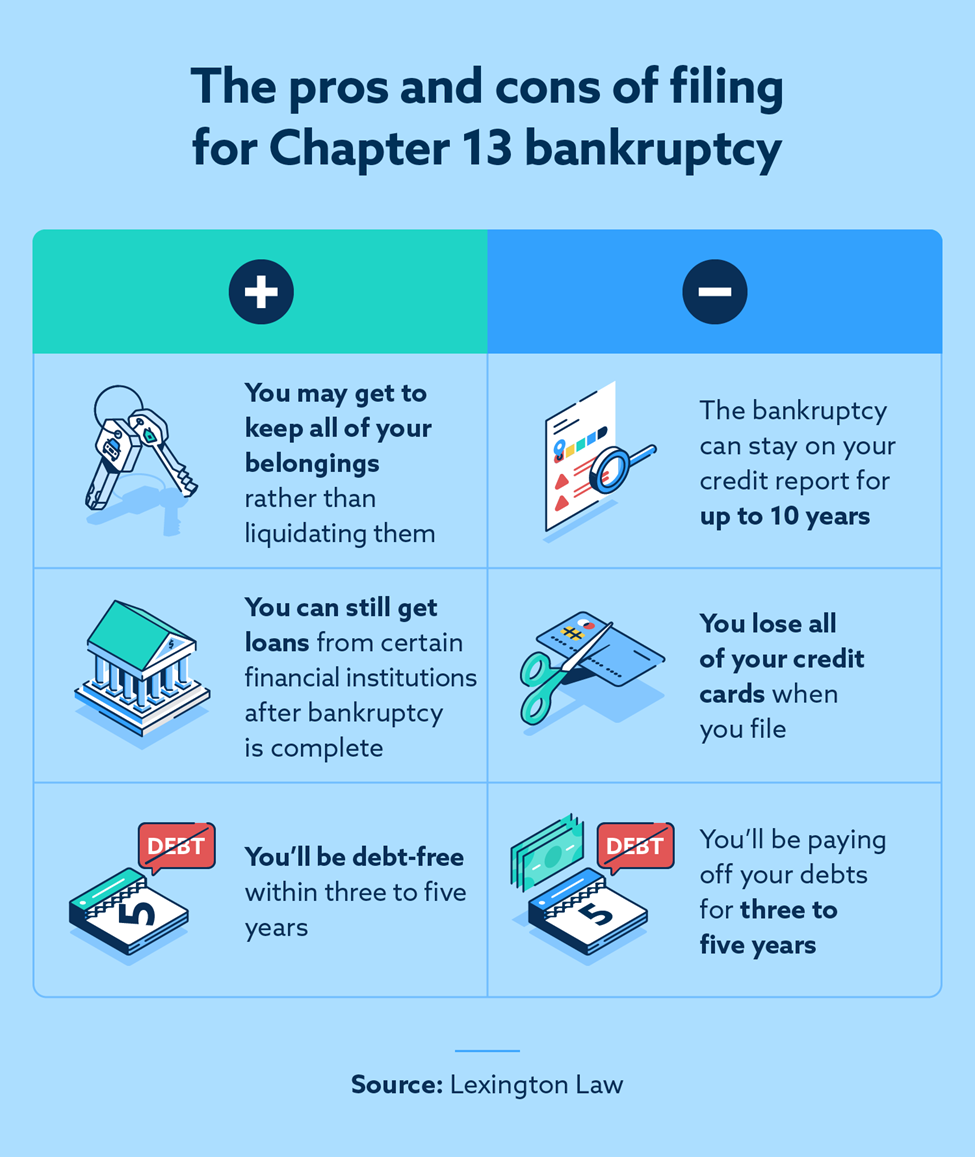

What Is Chapter 13 Bankruptcy? Lexington Law

What is a Chapter 13 and how does it work?

What Is Chapter 13 Bankruptcy and Is It Worth It? TheStreet

What Is Chapter 13 Bankruptcy? Definition & Eligibility TheStreet

What Is Chapter 13 Bankruptcy? Lexington Law

Finally Financial Freedom Is The.

In Chapter 13 Bankruptcy, The Debtor Proposes A Repayment Plan To Pay Off Creditors Over Three To Five Years.

No Way To Failrush Filing Available

The Debtor Must Complete The Educational Courses Before.

Related Post: